17th February, 2018

The Office for National Statistics (ONS) publishes data on UK Business activity, size and location annually. In March 2017 there were 2,668,810 million businesses registered in the UK for VAT and/or PAYE (Pay As You Earn). Compared with 2,554,510 million in March 2016 – a rise of around 4.5% (114,300) and slightly higher than the 4.3% rise the year before.

Between 2015 and 2016, and now 2016 to 2017, all regions have seen an increase in the number of VAT and/or PAYE businesses. In the South West the total number of businesses went from 226,575 in March 2016 to 234,345 in March 2017, a rise of 7,770 (3.4%) in total, 6th in terms of growth among the 13 UK regions. However, growth appears slower in Cornwall & Isles of Scilly, where the number of VAT/PAYE businesses has risen by just 360 (1.5%), though similar to the rate of growth experienced 2015-16 and 2014-15.

Compared to the UK as a whole the growth rate of businesses in Cornwall and the Isles of Scilly is therefore just a third of UK overall.

London, which has the largest number of VAT and/or PAYE-based businesses and traditionally has shown the largest growth among all regions was ‘only’ fourth in 2016-17 with a growth rate of 6.0% (previously 7.2% in 2015-2016).

Table 1: Number of UK VAT and/or PAYE based enterprises by location, 2015 to 2017 (Count given to the nearest thousand)

| 2015 | % growth | 2016 | % growth | 2017 | |

| Cornwall & Isles of Scilly | 23.1 | 1.4 | 23.5 | 1.5 | 23.8 |

| South West | 221 | 2.6 | 227 | 3.4 | 234 |

| UK | 2,449 | 4.3 | 2,555 | 4.5 | 2,668 |

UK wide, the number of companies and public corporations has continued to rise and represents 70.7% of total businesses. The number of sole proprietors and partnerships has continued to decline and now represents 25.6% of total businesses, down 1.8 percentage points since 2016.

In the South West[1], companies make up a smaller proportion of businesses, at 60.7%, and sole proprietors and partnerships make up a correspondingly higher proportion, at 33.1%. Non-profit bodies or mutual associations make up 3.4% of businesses in the South West which is broadly in line with the UK average at 3.3%.

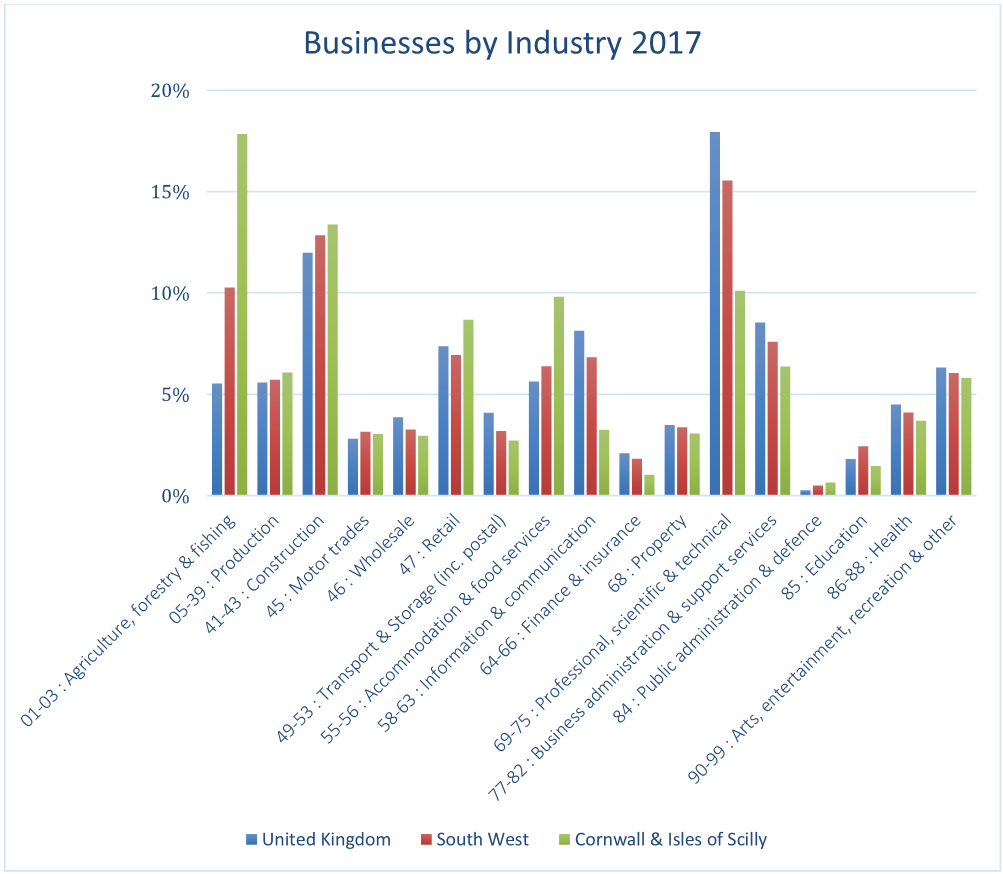

In 2017, agriculture, forestry & fishing remains the largest industry group in Cornwall and Scilly with 17.9% of all registered businesses. Construction (13.4%) is still next largest, followed by professional, scientific and technical businesses (10.1%) and accommodation and food services (9.8%).

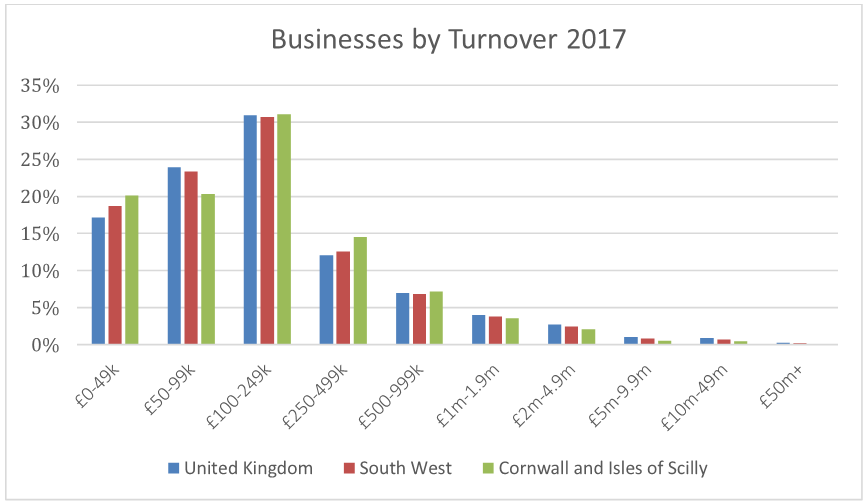

The ONS 2017 data shows that Cornwall & Isles of Scilly still has a higher proportion of businesses in the lowest turnover band (less than £50,000), with 20.1% compared to the UK average of 17.2%. It also still has fewer bigger businesses with a turnover of £1m and over – 6.7% (down from 7.5%) of businesses in Cornwall & Isles of Scilly operate at the highest turnover levels compared to 8.9% (down from 9.2%) across the UK as a whole.

In terms of employment size, the 2017 stats are similar to previous years; Cornwall & Scilly is still representative of the UK average, except:

Also, there is still no conclusive evidence to suggest that Cornwall and Isles of Scilly has a significantly higher proportion of micro entities than the UK as a whole[2]:

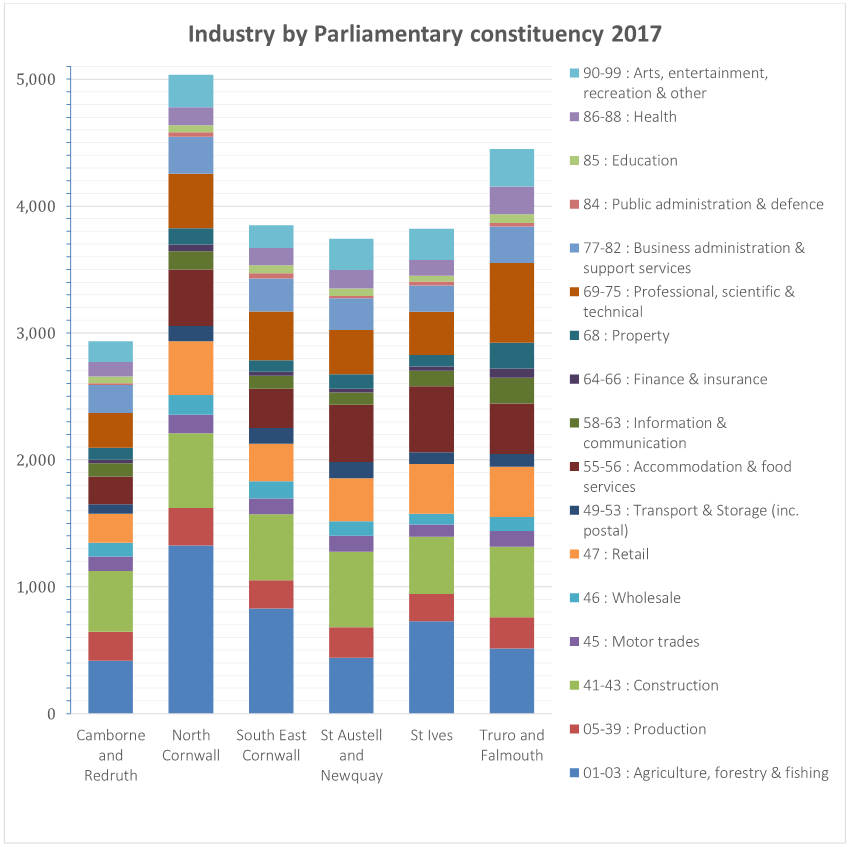

North Cornwall, the largest area geographically, still has the greatest number of VAT/PAYE registered businesses with 5,035 in total. Truro and Falmouth come next with 4,450 businesses. South East Cornwall has 3,850 registered businesses followed by St Ives with 3,820 businesses. St Austell & Newquay has 3,740 businesses and is the area showing the largest growth with 3.7% more enterprises than 2016. Camborne & Redruth has the fewest businesses, with 2,935.

By industry:

In terms of business size – about three quarters of businesses in Cornwall have less than 5 employees. Businesses with 5-9 employees represent the second largest group with close to or just over 14% across Cornwall. North Cornwall has the highest proportion of businesses (22.8%) within the lowest turnover band of less than £50,000.

Camborne and Redruth, as the area with the least number of businesses, has the highest proportion of businesses employing over 10 people (13.8%). It is also the area with the highest proportion of businesses turning over £1m or more. In terms of absolute numbers however, Truro & Falmouth has the greatest number of businesses (575) with 10 or more employees, followed by North Cornwall (with 505, which is down from 520 in 2016).

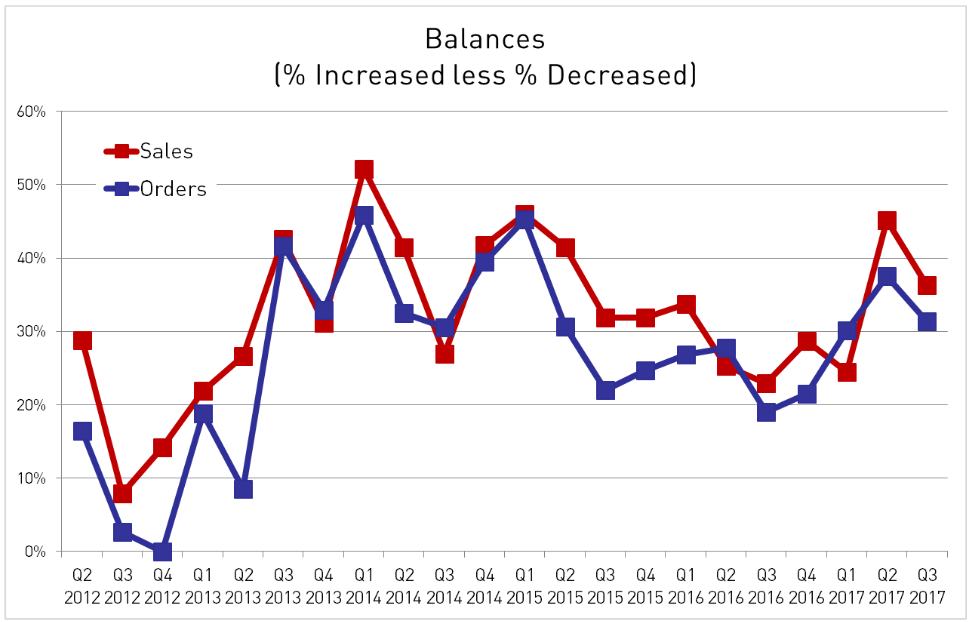

PFA Research conducts the Quarterly Economic Survey (QES) in Cornwall on behalf of Cornwall Chamber and the British Chambers of Commerce. By analysing the results across the last five years, we see a more longitudinal picture and the trends over time…

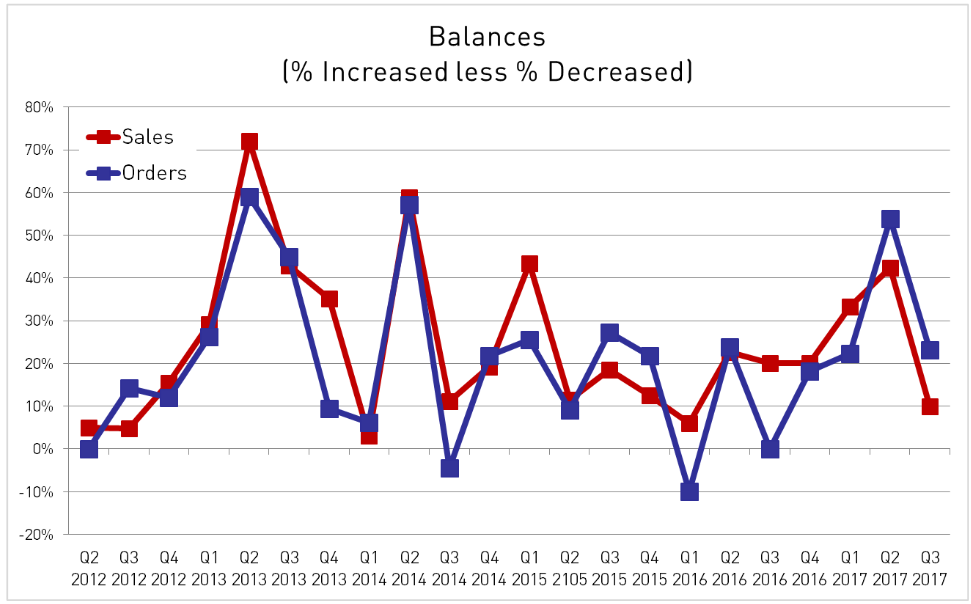

The following chart shows the net difference between those saying last quarter sales / advanced orders increased or decreased:

As an indicator of business confidence over the long term, the trend shows a positive net increase with balances increasing since the third quarter of 2016.

About a quarter of businesses who contribute to Cornwall Chamber’s QES are exporters. Sales and advanced orders have increased over 12 months from 2016 Q3 only to decline again in the third quarter of 2017.

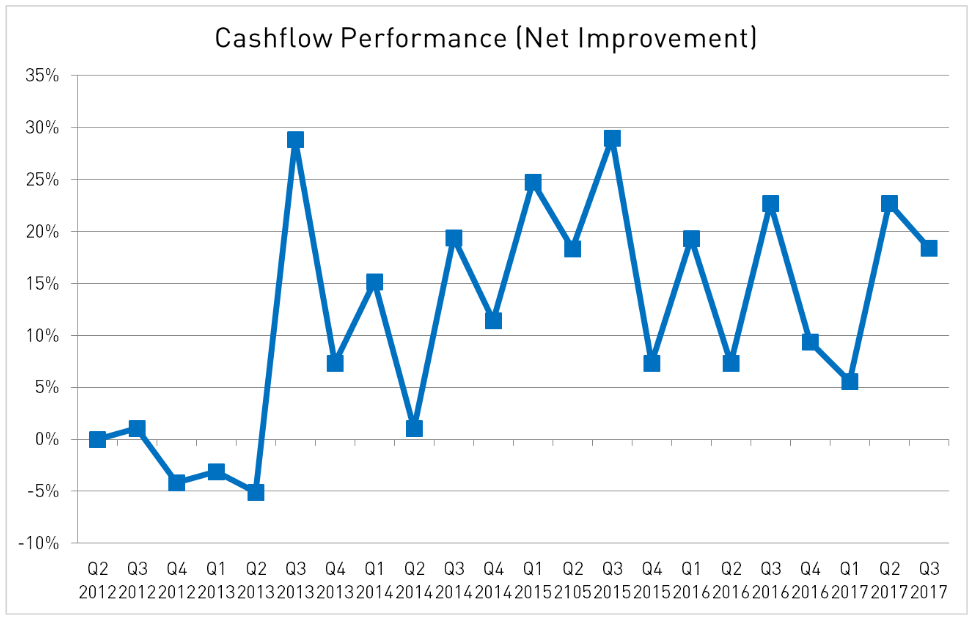

Cashflow performance tends to rise after fall and fall after rise from quarter to quarter. However, there was a subsequent fall in Q1 this year, the first time in five years, although overall cashflow remains fairly strong over where it was just a few years ago.

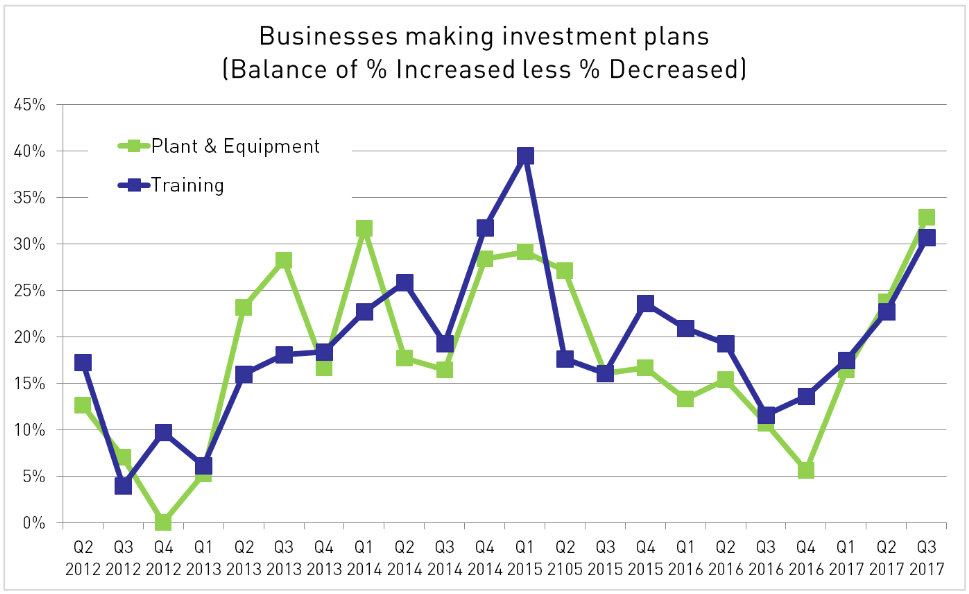

There has been a steady increase in the balances of plans for investment in plant, machinery and equipment and training since Q3 of 2016, suggesting a more positive attitude in what are still uncertain times for many.

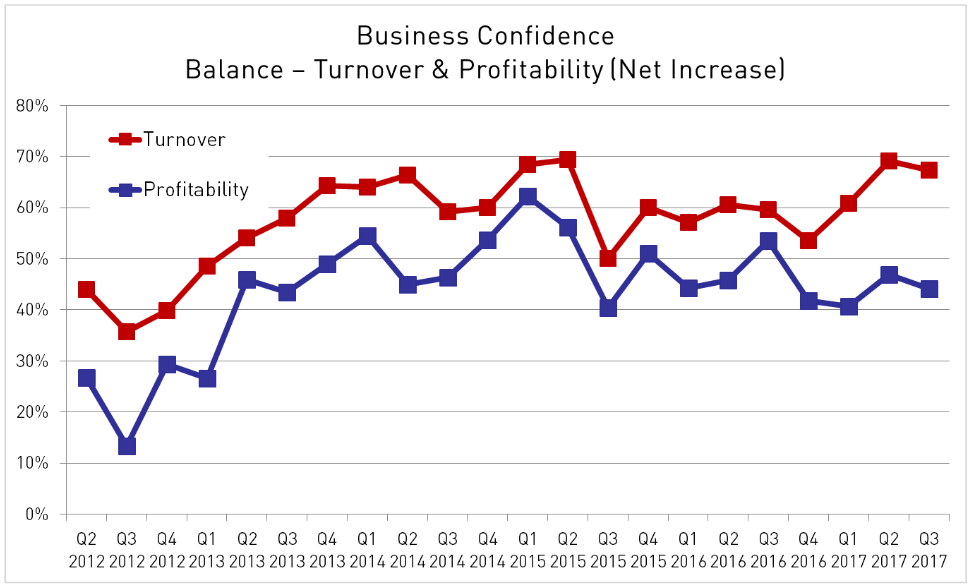

The QES questions relating to turnover and profitability relate to business owners’ expectations for the next 12 months.

This ‘snapshot’ of business confidence at quarterly intervals over the last five years shows a more positive expectation of turnover rising though the gap between that and confidence in profitability increasing has widened.

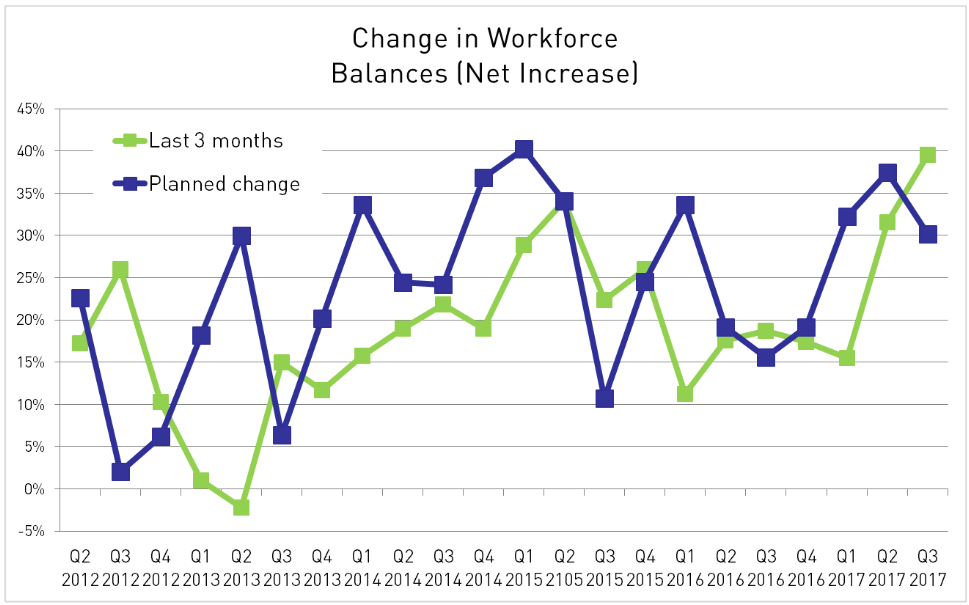

Aligned with business confidence increasing through 2017, reports of increases in workforce and forecasts have also been positive through 2017, with only a dip in the planned change over this last quarter.

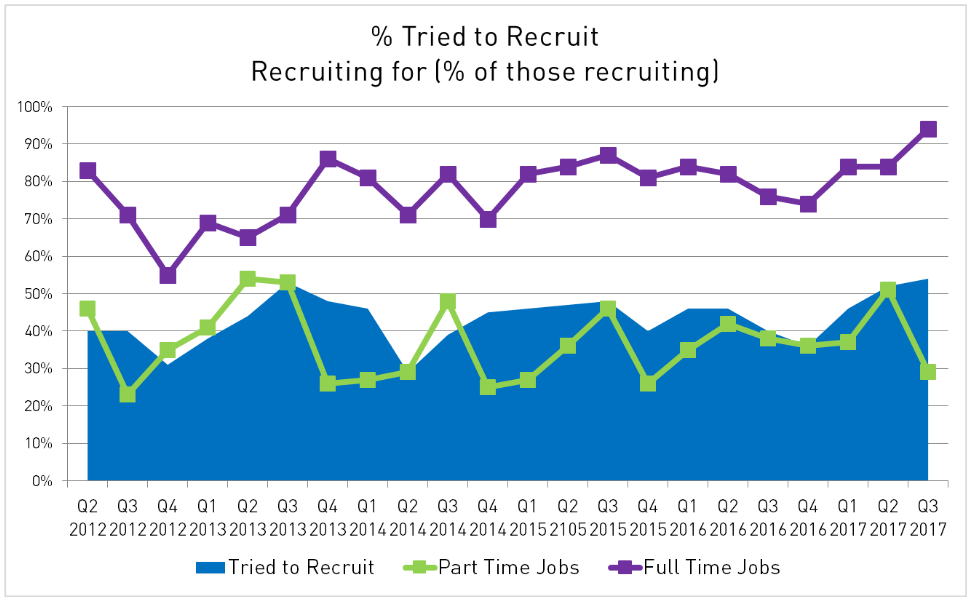

After a fairly stable period in terms of the types of positions looking to be filled, 2017 has seen an increase in the proportion of businesses trying to recruit (now over 50%, last seen at that level four years ago) and the need for filling full time vacancies rather than part-time.

Cornish businesses appear to be responding positively to what is still an uncertain time for many as Brexit approaches.

‘Confidence’ is relatively high in terms of expected sales (turnover) but the gap between the balance scores of turnover and profitability has widened which is unlikely to be sustainable. Businesses have increased their workforces and more businesses are trying to recruit staff and increasingly into full-time roles. Supporting this, the proportion of businesses saying they are increasing investments into capital projects and also staff training (skills) have risen steadily over the last 12 months. Cashflow performance remains fairly positive but it will be interesting to see if the rate starts to track negatively after the obvious increase in investments this year.

Growth in number of businesses continues in Cornwall (at 1.5%), albeit at half the rate of the South West as a whole and a third of the UK rate. The agricultural industry is still the largest industry in Cornwall (though evidently in decline) but the professional, scientific and technical sector continues to emerge, especially in the Truro & Falmouth areas) and now exceeds the number in the accommodation and food sector.

[1] Figures for Cornwall & Isles of Scilly alone are not available.

[2] It is not possible to cross analyse ONS statistics at a business level. The strict definition as to what constitutes a ‘micro-entity’ is where at least two of the following criteria are met:

This article was produced for and published in the December 2017/January 2018 edition of Business Cornwall magazine.