1st March, 2016

The Federation of Small Businesses (FSB) is the UK’s largest campaigning pressure group promoting and protecting the interests of the self-employed and small business owners. In Cornwall, FSB has around 5,000 members and in 2015 it engaged PFA Research to independently evaluate views from local businesses regarding business support and funding in Cornwall.

277 businesses participated, representative of the Cornwall FSB membership, through an online survey and telephone interviews:

57% have been in business for at least 10 years and 5% for no more than one year; 53% employ part-time staff and 8% have no full-time staff; 69% are family run businesses; 43% run a home-based business or a business that includes live-in accommodation and a fifth of businesses are based in a town centre / high street location.

Research participants were invited to share their experience of what has and has not worked, what could be improved and what the gaps are for business owners when accessing support and funding for their businesses.

Participants were asked about their business plans, objectives and how they planned to achieve business growth over the next three years.

Asked to rate how well their business manages various functions:

Around 1 in 3 respondents do not have a business plan and do not feel that their business needs one. More than half of participants are hoping to achieve rapid growth (5%) or moderate or sustainable growth (50%) in the next three years.

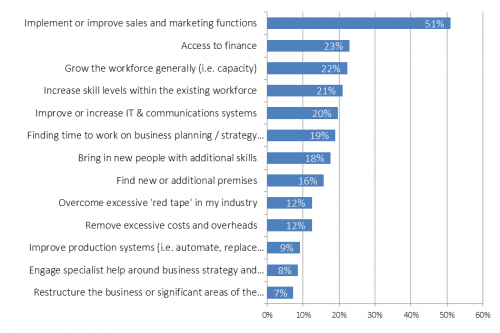

Q: What do you need to do to make your business growth happen?

Figure 1 – Business Growth Facilitators

(Base: Rapid growth / Moderate / sustainable growth n=153)

Participants were asked about whether they had received business support, their experiences of that support and whether they encountered any difficulties.

As is commonly recorded in business surveys, the most commonly cited first port of call for business advice is an accountant, cited by 38% of participants. This is very closely followed by the FSB, with 37%, and to be expected among a survey with a significant sample of FSB members. The wealth of information available online puts ‘the internet’ as a source in third place, with 19%.

Over half, 53%, say they have accessed business support in the past.

The majority, 71%, of those receiving support, were very or fairly satisfied with the support they received. Those who received the support without any direct cost to themselves are more satisfied than those who had to pay either partly or in full (80% vs 63%).

When asked in what formats they would prefer to access business support, half chose ‘one-to-one specialist advice, mentoring or coaching’, and a third ‘resources on the internet’ followed by local seminars and workshops (27%) and online training (19%).

Q: In what formats would you prefer to access business support?

Figure 2 – Preferred Format of Business Support

(Base: All respondents, n=277 Top ten responses shown.)

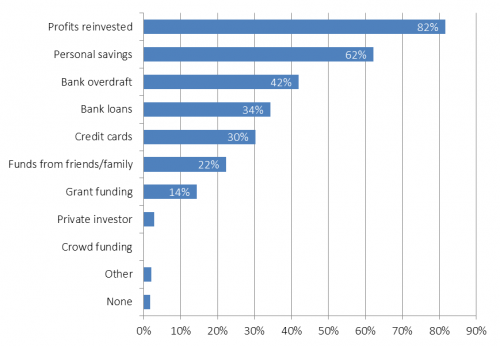

Businesses were asked about how they have invested in their business, whether they have received grant funding and how satisfied they were with the process and whether they are disadvantaged when it comes to accessing certain types of business funding.

Participants have invested in their businesses using a wide range of financial resources, most commonly through cash investment with profits re-invested (82%), personal savings (62%) or debt finance through bank overdraft (42%), bank loans (34%) or credit cards (30%.) 22% are indebted to friends and family. Just 14% have received grant funding and none in this sample have yet to use crowd funding.

Q: Which of the following have you used to invest in your business?

Figure 3 – Business Investment

(Base: All respondents, n=277)

One quarter of participants say their business is currently in need of funding:

The full research findings will be published by FSB in the Spring, and will be available on FSB Cornwall Region website: http://www.fsb.org.uk/regions/cornwall

[1] Source: Office for National Statistics (ONS) Business Activity, Size & Location 2015: see our interactive dashboard for more information.