25th November, 2014

The market research landscape is a continually evolving metastructure of technologies, methodologies and most importantly, people. The industry is consistently learning. A raft of electronic capture points, increased mobile capacities and a deeper understanding of connectivity is morphing communications is underpinning the progression of market research in the 21st Century. Do we understand the main movers and shakers in the current environment? Do we know how our current activities will shape the landscape to come?

It’s a wide ranging set of questions with no single, easy answer. So here, we have gathered a number of the latest trends and movements molding the market as we know it.

The rise of mobile market research has finished. It has risen and it is here. The market research industry has spectacularly embraced mobile research methodologies, using them to underscore the transition into our ultra-connected society. The results of mobile data are far reaching: bespoke customer campaigns, increased relevance (hyper-targeting) and conversion from advertising, in-the-field and point-of-sale insight gathering, geo-aware insight gathering and of course, mobile survey tools that have enabled rich-media feedback from participants from wherever they are.

The results of mobile are clear to see for researchers already using the technology. Ethnographic studies can be conducted across large distances, with research coordinators no longer bound by a single locale, or forcing individuals into a monitored environment. Video, chat, polling and consistent networking have removed the daunting financial pressures of monitored environment studies, too. Mobile market research is at the core of embracing a societal shift into dynamic, real-time working and business environments that require immersive, dedicated researchers who can use technologies to their advantage.

Depending on what you read Big Data is either the saviour of worlds, or a behemoth waiting to be tackled. Either way, in our data production in general is vastly outstripping any other period in human history. Understandable, given our recent history of computing, networking and data infrastructure, as well as our ever-increasing ability to actually monitor and store the information we generate.

Big Data is here to stay and rather than succumb to the automatic assumption that having access to more data will improve survey accuracy, sample quality or our data analysis skills, we should use Big Data to compliment each of those areas and more. Big Data will not replace market research. Big Data is proving to be an efficient tool in analysing past events, in uncovering trends in massive, rich datasets we have previously missed. But the industry isn’t drowning in data, nor are researchers placing all their chips on the prospect of data mining and analytics to hold all the answers. There is an opportunity to use the market researchers friend – data – to learn from the past and engage the future.

Those researchers exploring and exploiting the so called “3 Vs” – Volume, Variety and Velocity – may well be in a prime seat, but as evidenced through Big Data itself, the nature of the game can change rapidly.

Along with Big Data, the social media spectrum has vastly increased the touching points for information gathering practices for market researchers outside the traditional. Monitoring social media has a instantaneous feedback appeal, providing market researchers the opportunity to engage with or mine data from the thousands upon thousands of conversations taking place around the globe. Social media listening can be a cost effective method of uncovering previously unseen trends or insights, or backing up traditional research data with additional findings.

Monitoring social media channels does come with its problems. Despite the global appeal of the social communication channels many of the most popular sites reside over a lopsided balance throughout their respective communities, leading to claims that the findings can be unrepresentative of the ‘real-world.’ Online social communities can also be perhaps unsurprisingly guilty of ‘hive-mind’ syndrome as ideas, truths, rumours and fallacies overlap in a great melting pot of content and unabashed opinion.

Despite these concerns social media listening proves to be a valuable resource in many studies and as the number of social services continues to rise, the number of actionable data collection points so to increases.

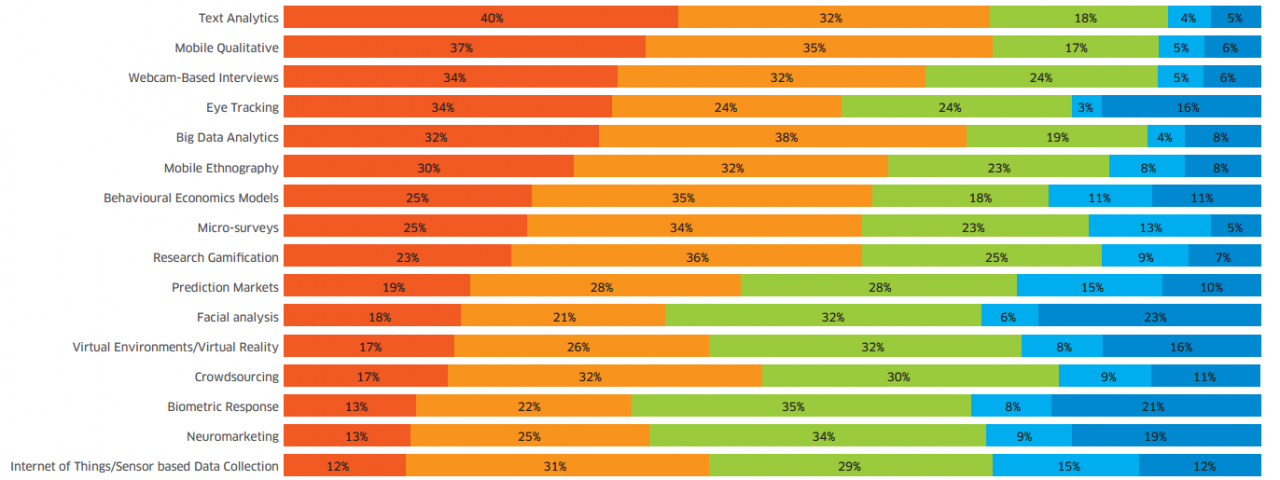

Judging by the latest edition of GRIT text analytics are fast moving toward being one of the most popular market research techniques. Rapidly quantifying survey feedback, translating raw qualitative data into actionable quantitative information, discerning between positive and negative, extrapolating survey themes, keyword density analysis and semantic awareness all feature in the current exploratory trends in text analytics.

It is a precise and difficult semantic science. Text analytics software platforms must be able to understand the textual difference between different strands of unstructured data whilst negating the irregularities of human input. Participants, in some cases, will deliver a vast tranche of qualitative data if given the opportunity. Automating time consuming processes such as text analysis are seen as a way of freeing up researchers whilst simultaneously feeding the data machine, expanding on the amount of data available for analysis. The platforms that currently exist are all consistently in development. Small facets of human input can interrupt text analytics – hyphens, periods, irregular syntax – so the ongoing goal for the text analysis community is establishing 99.9% perfect analytics software.

Wearable technologies are not entirely shaping the research landscape, but as the wearables operating market expands from Google Glass and heartrate/fitness monitors into all manner of clothing, fashion, jewellery and lifestyle must-have’s, the practical applications of wearable technologies become more apparent for market researchers. The very nature of wearable technologies open up the vast potential of biometric measurement and analysis of willing participants, not only for market research, but for medicine, safety and security, communication, fashion, design, automation and many, many more existing and prospective markets.

Gathering implicit data through biometric measuring is a delicate subject for market researchers, always striving to maintain the privacy of their participants and their data. Whilst the mobile wave has allowed market researchers to assimilate further with their participants we still resolve to understand the physiological factors at play in decision making processes. Instant mobile surveying has increased immediate insights, but many potential participants respond with ‘cant say/wont say’ answers. Being able to instantly contextualise a set of answers with a biometric readout delivered through wearable technologies explores the behavioural root of decision making, granting market researchers an outstanding insight tool.

We cannot write an article concerning market research trends and leave out the humble survey. The survey has come under scrutiny this year. Declared dead in some parts, the survey has morphed with the market research industry. Surveying participants immediately following a transaction or actionable moment drops the researcher into the pocket of the individual. However, mobile must remain exactly that: mobile. Participants on the move, shopping, lunching and networking don’t want a 20 question survey following each action. It is distracting and time consuming in our digitised society. Micro-surveys now provide ample data feedback for situation questionnaires and participants utilising smart-devices can further their feedback using the full range of rich-media inputs available in the palm of their hand.

It’s no wonder that 64% of GRIT respondents indicated their current usage of mobile surveys, with only 1% indicating they ‘don’t expect to use’ the technology. That’s a rise of 13% since the last GRIT survey placing mobile surveying firmly at the top of the trending technologies pile.

Yes, indeed. There is always more to come!

Here is a quick list of additional technologies and data capturing techniques that haven’t quite trended – yet:

Not every technology will appeal entirely to your business model. And of course, you may not need to adapt the traditional market research techniques you know so well. But the industry is shifting, as are the expectations of clientele as their exposure to technology and the insight it can garner increases. Keeping one eye on the future is always wise!